ICC prosecutor seeks arrest warrants for Netanyahu, Hamas leaders

Israel has denied committing war crimes despite bombarding Gaza since the Hamas-led attack on October 7.

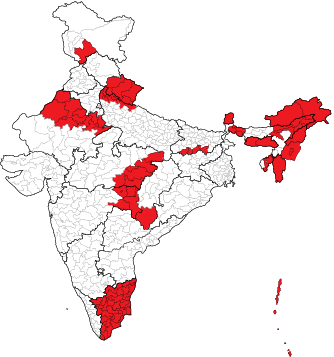

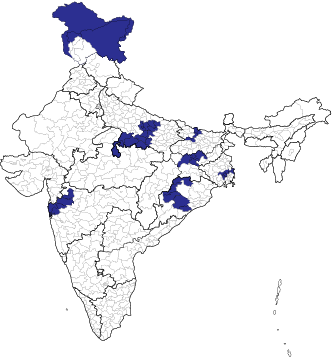

Phase 1 April 19

21 States

102 Constituencies

- Arunachal Pradesh (2)

- Assam (5)

- Bihar (4)

- Chhattisgarh (1)

- Madhya Pradesh (6)

- Maharashtra (5)

- Manipur (2)

- Meghalaya (2)

- Mizoram (1)

- Nagaland (1)

- Rajasthan (12)

- Sikkim (1)

- Tamil Nadu (39)

- Tripura (1)

- Uttar Pradesh (8)

- Uttarakhand (5)

- West Bengal (3)

- Andaman and Nicobar Islands (1)

- Jammu and Kashmir (1)

- Lakshadweep (1)

- Puducherry (1)

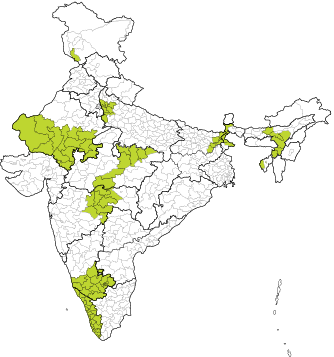

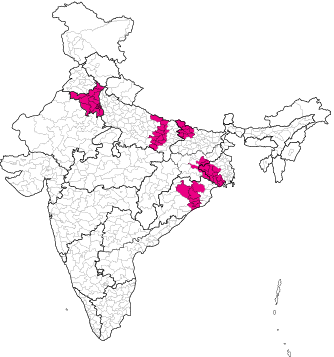

Phase 2 April 26

13 States

89 Constituencies

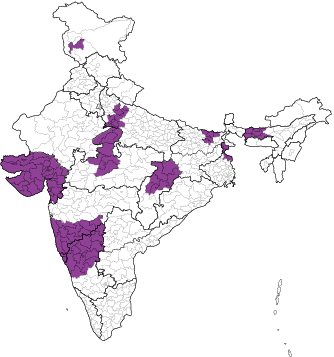

Phase 3 May 7

12 States

94 Constituencies

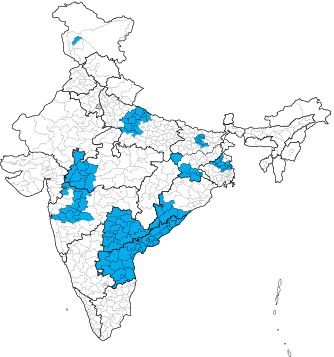

Phase 4 May 13

10 States

96 Constituencies

Phase 5 May 20

8 States

49 Constituencies

Phase 6 May 25

7 States

57 Constituencies

Phase 7 June 1

8 States

57 Constituencies

| Constituency | 2024 | 2019 |

|---|---|---|

| Thiruvananthapuram | 66.47% | 73.66% |

| Attingal | 69.48% | 74.4% |

| Kollam | 68.15% | 74.66% |

| Pathanamthitta | 63.37% | 74.24% |

| Mavelikkara | 65.95% | 74.23% |

| Alappuzha | 75.05% | 80.25% |

| Kottayam | 65.61% | 75.44% |

| Constituency | 2024 | 2019 |

|---|---|---|

| Idukki | 66.55% | 76.34% |

| Ernakulam | 68.29% | 77.63% |

| Chalakudy | 71.94% | 80.49% |

| Thrissur | 72.90% | 77.92% |

| Alathur | 73.42% | 80.42% |

| Palakkad | 73.57% | 77.72% |

| Ponnani | 69.34% | 74.98% |

| Constituency | 2024 | 2019 |

|---|---|---|

| Malappuram | 72.95% | 75.49% |

| Kozhikode | 75.52% | 81.65% |

| Wayanad | 73.57% | 80.33% |

| Vadakara | 78.41% | 82.67% |

| Kannur | 77.21% | 83.21% |

| Kasaragod | 76.04% | 80.65% |